Strike a balance to avoid regrets |

A primary job of financial planners is to help their clients see what is possible. It is also to help them balance living today while preparing them for tomorrow. But not knowing how many tomorrows we have can create too much emphasis on an uncertain future.

0 Comments

WILMINGTON, DEL.

|

Cicadas |

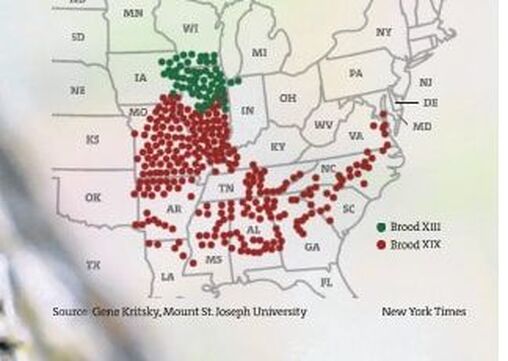

The cicadas are coming — and if you're in the Midwest or the Southeast, they will be more plentiful than ever. Or at least since the Louisiana Purchase.

This spring, for the first time since 1803, two cicada groups known as Brood XIX, or the Great Southern Brood, and Brood XIII, or the Northern Illinois Brood, are set to appear at the same time, in what is known as a dual emergence.

The last time the Northern Illinois Brood's 17-year cycle aligned with the Great Southern Brood's 13-year period, Thomas Jefferson was president. After this spring, it'll be another 221 years before the broods, which are geographically adjacent, appear together again.

"Nobody alive today will see it happen again," said Floyd Shockley, an entomologist and collections manager at the Smithsonian National Museum of Natural History.

"That's really rather humbling."

These insects will begin to appear in late April. They'll use their forelegs to tunnel out from the earth, their beady red eyes looking for a spot where they can peacefully finish maturing. A few days after they emerge and molt, the males will start buzzing in an effort to find a mate, a slow-building crescendo of noise that in a chorus can be louder than a plane.

Shockley said the dual emergence would most likely result in more than 1 trillion cicadas appearing in the roughly 16-state area where the two broods are generally seen. Forested areas, including urban green spaces, will have higher numbers than will agricultural regions. To put that into perspective, 1 trillion cicadas, each of which are just over an inch long, would cover 15,782,828 miles if they were laid end to end. "That cicada train would reach to the moon and back 33 times," he said.

One of the more exciting aspects of this dual emergence, Shockley said, lies in the possibility of interbreeding along the narrow band in northern Illinois where the two broods will overlap.

In most cases, Shockley said, the cicadas, which live about a month, will die not far from where they emerged. But since they're not great at flying and even worse at landing, cicadas often end up on sidewalks and city streets, where they can be squished by people or cars and "could conceivably make things slick."

" But rather than throwing in the trash or cleaning up with street sweepers, people should consider them basically free fertilizer for the plants in their gardens and natural areas," he said A ll told, these areas will be buzzing for about six weeks as the insects fly around looking to mate and deposit their eggs into slits they cut into tree branches.

Then they'll die, bringing with them a smell described by Shockley as similar to rotting nuts, as their bodies decay.

The insects are clumsy flyers, making them easy prey for predators like birds. They don't bite, sting or carry any diseases, and they serve as natural gardeners.

The holes they leave behind help aerate the soil and allow for rainwater to get underground and nourish tree roots in hot summer months. The slits they make in trees can cause some branches to break, and the leaves then turn brown in a process known as "flagging." But it's like a natural pruning, and when the tree grows the branch again, the fruit will be larger. The cicadas' rotting bodies provide nutrients that trees need.

John Cooley, a biology professor at the University of Connecticut, said his best advice for people living in the regions of the dual emergence is to let the bugs be.

"The forest is where they live," he said. "They are a part of the forest. Don't try to kill them.

Don't try to spray insecticide, all that kind of thing. That's just going to end badly because there are more than you could possibly kill with insecticide; you'd end up killing everything."

While the prospect of the 1 trillion cicadas might sound horrifying, Shockley emphasized the awe of this rare natural event.

"Don't be scared of it. Embrace it for the wondrous event that it is and embrace the fact that it's very temporary," he said.

Floods, fires, historic storms — severe weather events are on the rise. If your home was hit by high water or a wildfire, would your important papers be safe?

"Unfortunately, I've had clients who've been victims of fires, flooding, hurricanes," said Sev Tamayo, an agent with Goosehead Insurance in Florida. "Some of them were prepared and some of them weren't."

Don't be unprepared. Here's what you need to do to protect your important documents.

The most important items to keep in a safe place are things that are difficult to replicate, which includes documents that prove identity, legal process or ownership.

If you would have to call a government agency to process a replacement, you probably want to store it somewhere where it can stay damage free.

You should also consider what you would need to access if a disaster strikes.

Here are some items to consider, according to the Federal Emergency Management Agency:

* Birth, adoption, death, marriage and divorce certificates.

* Passports, green cards and Social Security cards.

* Property documents pertaining to your home or rental properties, mortgage or lease, and vehicles.

* Pet ownership paperwork.

* Paper stock and bond certificates.

* Military discharge papers.

*Health records, health insurance information and disabilities documentation.

* Estate planning documents (powers of attorney, wills, advance directives and trust agreements).

*Property insurance documents, including policy numbers and declarations pages.

* Tax records.

*Financial statements (loans, credit cards, banks, retirement accounts and investment accounts), as well as income records (pay stubs and government benefits).

* Copies of driver's licenses and other IDs, health insurance cards and credit cards.

* Family photos or heirlooms.

"It's also a good idea to keep scans of your critical documents, as well as backups of all your computer files on a storage device at a separate location, or in the cloud," said Pete Duncanson of Service- Master Restore, a restoration service company.

In some cases, a copy of a document will suffice in an emergency. This doesn't mean you shouldn't keep the original — but if you lose the original, you may be able to get by with your digital copy.

If you need to file an insurance claim, your insurer will need proof of what you owned.

Keeping a record of your things is tedious — but you probably have a smartphone with a camera.

"Start from the front door, turn on the video camera, take a quick two-minute walk around your house," Tamayo said. "Save it on the cloud."

Do this once a year. Let your insurance renewal be your cue, or set a calendar reminder — and refresh it when you've made a major purchase or renovation.

Store important documents in a container that makes the most sense for your particular risks with an eye toward preparing for the unexpected.

Here are some options:

* Fireproof safe: You can get a fireproof safe box for under $50, but keep in mind that they come in a variety of sizes and temperature ratings. Some are waterproof.

* Safe-deposit box: A safe-deposit box at a bank can weather a lot of events. But don't put anything there that you might need in a hurry — such as a passport for a last-minute trip.

* Plastic bin: At the very least, you can put important documents in a watertight plastic bin on a high shelf.

* Fridge or freezer: Putting your documents in a plastic zip-close bag in your refrigerator or freezer can also protect them, although it's not a long-term solution.

SEOUL, SOUTH KOREA - The Chinese corporate giant BYD said Monday that it sold 3 million battery-powered cars in 2023, its most ever, capping a turbulent year for China's electric vehicle industry.

Even as sales surged, heavy competition and a sustained price war took a financial toll on many automakers.

But BYD last year sold 1.6 million fully electric vehicles and another 1.4 million hybrids, which are powered by both batteries and gasoline.

Together that is a 62% increase over 2022. BYD is also making money, tripling its profit to $1.5 billion in the first half of last year.

All told, Chinese automakers are expected to have sold about 9.4 million electric vehicles and hybrids last year, an increase from 6.9 million in 2022, according to the China Association of Automobile Manufacturers. The group said it expected sales in 2024 to rise again, to 11.5 million.

Already the world's largest automobile market, China is now also its fastest growing, racing ahead in the electric vehicle transition that is upending the global industry.

China rules the supply chain for battery-powered cars — from the mining and processing of cobalt and other minerals used in batteries, to the deployment of robots in factories that make cars and trucks. China's electric vehicle companies and their suppliers employ some 1.5 million people.

A big reason for China's early lead in electric vehicles was the government's heavy financial support for the industry's development. After financial incentives for consumers expired at the end of 2022, automakers slashed car prices to lure buyers. Many companies including BYD introduced another round of cuts last fall, intensifying the price war.

Last year's price-cutting was started by Tesla, the American automaker that has a factory in Shanghai. In January 2023 it lowered prices in China for the second time in three months, and others followed.

Tesla is expected this week to report a big jump in its worldwide sales after slashing prices at the end of last year, and as customers took advantage of U.S. tax breaks.

Founded in 2003, Tesla is on a path to sell about 1.8 million battery-powered vehicles for the year, up from 1.3 million in 2022. It makes about half of all electric vehicles sold in the United States.

As Tesla and BYD compete for the spot as the world's most prolific maker of fully electric vehicles, both companies face increasing competition from legacy automakers that are spending billions of dollars to catch up.

"I think an industry shakeout is an inevitable trend," said Cui Dongshu, the secretarygeneral of the China Passenger Car Association, which represents the country's domestic industry. "But it's still uncertain who will seize the future leading position in the long term."

During the past year, Tesla has lost market share to rivals such as General Motors, Hyundai, Ford Motor Co. and Volkswagen as they introduced more electric vehicles.

BYD sells most of its cars in China but is expanding globally, particularly in Europe.

It announced in December that it would build an assembly plant in Hungary, its first production facility for battery powered cars in Europe. In Germany, the seat of European auto making, it introduced three models of electric cars at the start of 2023. BYD has opened dealerships in Germany, Norway and Sweden.

As global competition for electric vehicles has gotten more intense, the political ramifications have been heightened. U.S. policymakers have made it harder for foreign companies to become partners with American companies.

And in Europe, lawmakers are investigating China's state subsidies, a step that could lead to tariffs imposed by the European Union.

Yet Europe's auto industry can't ignore China as a customer and business partner.

BMW, which has more than 30,000 employees in China, announced last spring that it would invest about $1.4 billion in battery assembly capacity at its factory in Shenyang in China's northeast.

Volkswagen, which counts China as its largest sales market, is moving more of its supply chain and manufacturing to China.

Archives

July 2024

June 2024

April 2024

March 2024

February 2024

January 2024

December 2023

November 2023

October 2023

September 2023

August 2023

July 2023

June 2023

May 2023

April 2023

March 2023

February 2023

January 2023

December 2022

November 2022

October 2022

September 2022

August 2022

July 2022

June 2022

May 2022

April 2022

March 2022

February 2022

January 2022

December 2021

November 2021

October 2021

September 2021

August 2021

July 2021

June 2021

May 2021

April 2021

March 2021

February 2021

January 2021

December 2020

November 2020

October 2020

September 2020

August 2020

July 2020

June 2020

May 2020

April 2020

March 2020

February 2020

January 2020

December 2019

November 2019

October 2019

September 2019

August 2019

July 2019

June 2019

May 2019

April 2019

February 2019

January 2019

December 2018

November 2018

October 2018

September 2018

August 2018

July 2018

June 2018

May 2018

April 2018

RSS Feed

RSS Feed